Dominica Added To European Union Tax

The small Caribbean island joins other jurisdictions that promote good governance and maintain high standards of fair taxation. The countries in the list below are those that refused to engage with the EU or to address tax good governance shortcomings situation on 22 February 2021.

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

In addition to the five jurisdictions already listed the Council included 10 new ones.

Dominica added to european union tax. The Council today adopted conclusions on the revised EU list of non-cooperative jurisdictions for tax purposes deciding to add Dominica to the EU list of non-cooperative jurisdictions Annex I of the conclusions and to remove Barbados from that list. Dominica has been included in the EU list as it received a partially compliant rating from the Global Forum for Transparency and Exchange of Information and has not yet resolved this issue the Council of the. The Commonwealth of Dominica fully complies with EU tax criteria the European Council announced on Friday.

Living in Dominica The Commonwealth of Dominica The Commonwealth of Dominica is an island country situated in the Caribbean. The European Union announced today it has added Dominica to its tax haven blacklist now among reliable and approved Caribbean Citizenship Programs are St. The Council agreed to add Dominica to the list and to move Barbados to the grey list.

The final VAT levied on a good. This was justified by commitments made to address deficiencies identified by the EU. EU Adds Dominica Drops Barbados From Tax Blacklist Law360 February 22 2021 1154 AM EST -- European Union countries have dropped Barbados from their list of uncooperative jurisdictions for tax.

Dominica CABINET SECRETARIAT Press Statement On Monday February 22 2021 the Council of Ministers of the European Parliament adopted conclusions on the revised European Union EU list of non-cooperative jurisdictions for tax purposes and took the decision to add Dominica to the List of Non-Cooperative Jurisdictions. Namibia Morocco and Santa Lucia were removed from the document having fulfilled all their commitments. 2 years ago admin.

The European Union EU on Monday added Dominica to the so-called blacklist of jurisdictions considered non-cooperative for tax purposes. Dominica has been included in the EU list as it received a partially compliant rating from the Global Forum and has not yet resolved this issue. The EU List.

25042019 - Today at the OECD Headquarters in Paris HE. Certain cookies are used to obtain aggregated statistics about website visits to help us constantly improve the site and better serve your. On 22 February 2021 the European Council announced that it has decided to add Dominica to the EU list of noncooperative jurisdictions for tax purposes annex I referred to as the black list and to remove Barbados from that list.

Lucia Citizenship by Investment and Antigua and Barbuda Citizenship by Investment. This is after Dominica implemented a series of regulations. The VAT is a consumption tax assessed on the value added to goods and services.

It has now been granted a supplementary review by the Global Forum and has therefore been moved to a state-of-play. Kitts and Nevis Citizenship by Investment Grenada Citizenship by Investment St. This is because they have failed to make commitments at a high political level in response to all of the EUs concerns.

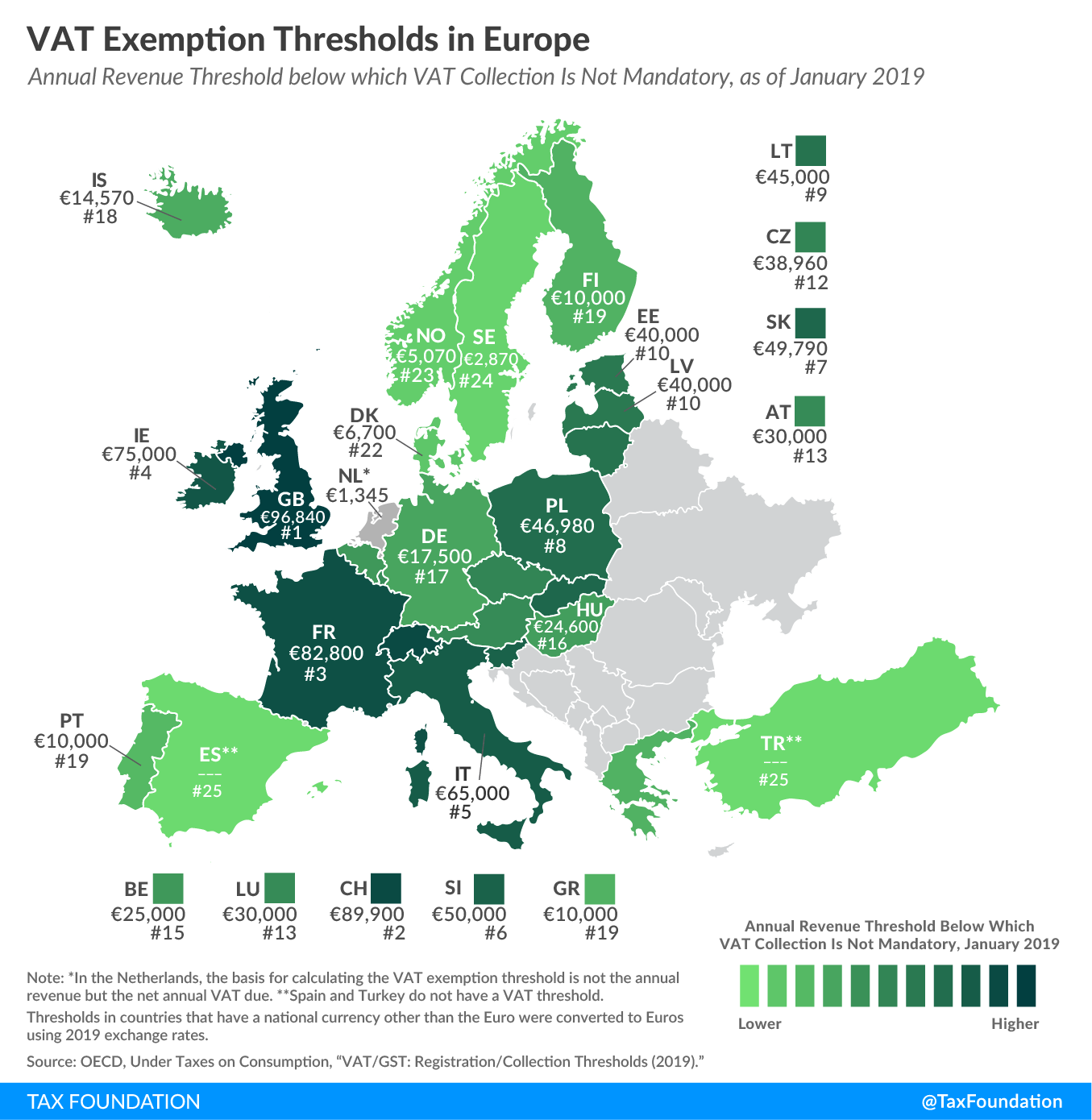

On February 22 2021 the Council adopted conclusions on a revised EU list of non-cooperative jurisdictions for tax purposes. American Samoa Anguilla Dominica Fiji Guam Palau Panama Samoa Seychelles Trinidad and Tobago US Virgin Islands Vanuatu. More than 140 countries worldwideincluding all European countrieslevy a Value-Added Tax VAT on purchases for consumption.

Sharlene Shillingford-McKlmon Ambassador of Dominica to the European Union signed the Multilateral Convention on Mutual Administrative Assistance in Tax Matters the Convention in the presence of the OECD Deputy. The Council added Dominica to the EU list of non-cooperative jurisdictions for tax purposes and removed Barbados from the list. Promised reforms have not been implemented and we are not seeing any money laundering arrests let alone convictions.

Promised reforms have not been implemented and we are not seeing any money laundering arrests let alone convictions. Dominica added to european union tax haven black list It is not surprising that the Commonwealth of Dominica was added this week to the EU Tax Haven Blacklist. Dominica has an estimated population of 73300 inhabitants and has a surface area of 2895 square miles 750 square kilometres.

EU Tax Compliance Says Dominica. It is a former British colony and gained its independence on the third of November 1978. Barbados was added to the EU list in October 2020 after it received a partially compliant rating from the Global Forum.

Aruba Barbados Belize Bermuda Dominica Fiji the Marshall Islands Oman the United Arab Emirates and Vanuatu. Caribbean island of dominica added to european union tax haven black list It is not surprising that the Commonwealth of Dominica was added this week to the EU Tax Haven Blacklist. We use cookies in order to ensure that you can get the best browsing experience possible on the Council website.

Dominica joins international efforts against tax evasion and avoidance. As todays tax map shows although harmonized to some extent by the European Union EU EU member states VAT rates vary across countries. At the same time the Council decided to add Anguilla Antigua and Barbuda the British Virgin Islands and Dominica to annex II.

These jurisdictions had not implemented the commitments they had made to the EU by the agreed 2018 deadline. Those commitments were assessed by EU experts and their. The list includes jurisdictions worldwide that either have not engaged in a constructive dialogue with the.

As A Full Service Global Law Firm Focused On Global I Gaming Financial Services Licensing Asset Management Business Tax Financial Services Asset Management

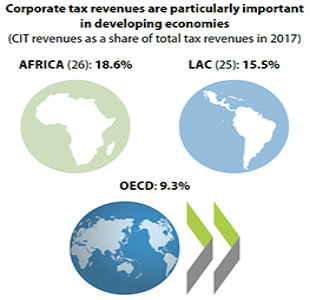

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Corporate Tax Statistics Database Oecd

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

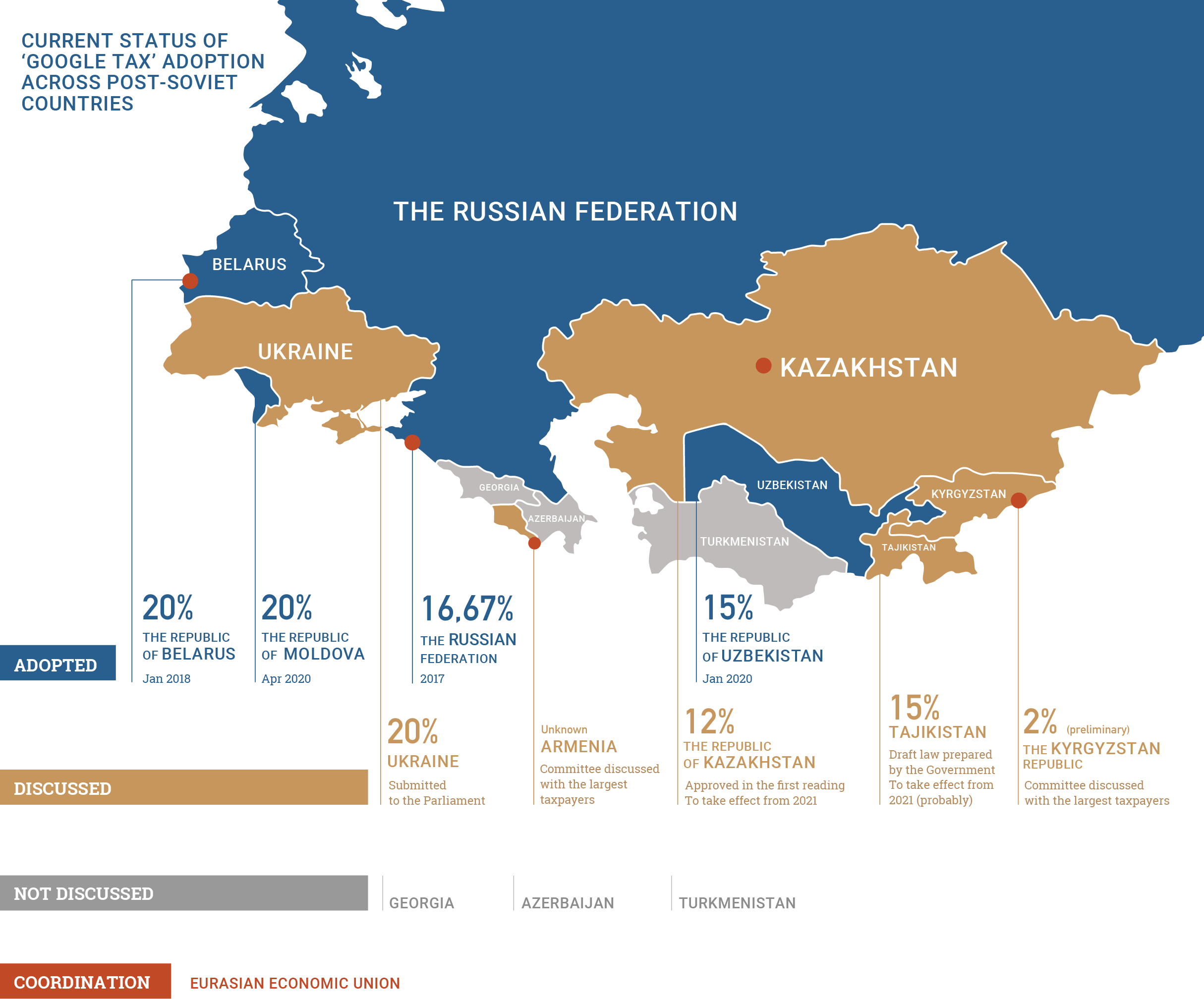

Google Tax Expansion Across The Post Soviet Countries

Eu Vat Thresholds Vat Exemption Thresholds In Europe

Denmark Corporate Tax Rate 1981 2021 Data 2022 2023 Forecast Historical Chart

Country Reviews And Advice Oecd

Eu Excise Duty On Alcohol Distilled Spirits Taxes Tax Foundation

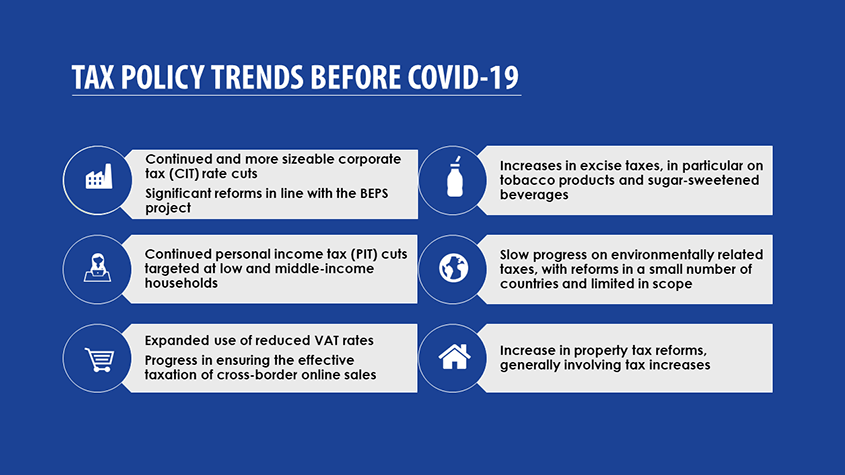

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Israel Corporate Tax Rate 2000 2021 Data 2022 2023 Forecast Historical Chart

Updates To The Eu List Of Non Cooperative Jurisdictions Kpmg Global

I Overview In Tax Harmonization In The European Community

Tax Relief For Families In Europe Tax Foundation Global Tax Policy