Tax Evasion Settlement With Kpmg And

The DPA was signed on August 26 2005. Tax shelters similar to those attacked by the prosecution in the KPMG tax fraud case.

Https Assets Kpmg Com Content Dam Kpmg Xx Pdf 2016 12 Around The World With Kpmgs Global Tax Dispute Controversy Network Pdf

Extended panel of SAC judges to determine the status of silos in real estate tax.

Tax evasion settlement with kpmg and. To enforce the agreement Richard Breeden the former Securities and Exchange Commission chairman who also oversaw MCI Inc. Last year KPMG agreed to pay 456 million and admitted to wrongdoing to resolve a. In the largest criminal tax case ever filed KPMG has admitted that it engaged in a fraud that generated at least 11 billion dollars in phony tax losses which according to court papers cost the United States at least 25 billion dollars in evaded taxes.

KPMG in an attempt to avoid the fate of Arthur Andersen agreed to cooperate in the investigation and paid 456 million in August to settle all charges against. Noncompliance is concentrated at the top of income distribution levels with the top 1 of taxpayers failing to report 20 of. Treasury Department today issued a release proposing increased IRS funding and improved tax compliance including in part by addressing the tax gap.

This settlement reflects the need to severely punish this sort of. The class action lawsuit sought compensation from KPMG and the law firm of Sidley Austin Brown Wood that provided legal advice on the shelters. KPMG agreed to settle the charges by paying a 50 million penalty and complying with a detailed set of undertakings including retaining an independent consultant to review and assess the firms ethics and integrity controls and its compliance with various undertakings.

KPMG discontinued most of its private client tax practice in 2002. Extended panel of SAC judges to determine the status of silos in real estate tax. Dennis Howlett former head of Canadians for Tax Fairness says the latest revelations about KPMGs tax system show rich people are playing a game of how far off the line you can skate and not get caught.

KPMG will pay a 456 million fine and admit it broke the law by developing a tax shelter that enabled wealthy clients to evade paying at least 25 billion in federal taxes. From 1996 through 2005 KPMG the fourth largest accounting firm in the US sold tax shelters to 250 investors who claimed they were defrauded. Treasury proposals for tax administration reforms.

We invite you to the next episode of the Weekly Tax Review prepared in cooperation with tax experts in KPMG in Poland. CBC Finally in 2019 the CRA agreed to a secret out-of-court settlement. The negligence claim against KPMG was restored.

Plaintiffs contend that but for Hasting and KPMGs misrepresentations that the SOS transaction KPMG proposed was. A tax expert who was prevented from speaking to a Commons committee about tax avoidance five years ago says its time for MPs to demand the identities of. It is 19 July 2021.

26 the Justice Dept. This settlement came a year after US DOJ prosecutors in Manhattan announced their investigation of Deutsche Banks role in questionable tax shelters. The DOJ eventually relented and agreed to let KPMG sign a Deferred Prosecution Agreement DPA in which KPMG admitted criminal and fraudulent misconduct and tax evasion agreed to work under a DOJ-appointed monitor for five years and paid a 456 million fine.

KPMG Weekly Tax Review 12 JUL - 19. Butler said Cohan would have no comment on the case. In addition to KPMGs former deputy chairman the individuals indicted today include two former heads of KPMGs tax practice and a former tax partner in the New.

Deloitte EY KPMG and PwC a systemic tax risk. In 2005 KPMG admitted to tax fraud conspiracy and settled with the US. The Canada Revenue Agencys decision to quietly cut a deal last month with wealthy KPMG clients caught in an offshore tax evasion scheme was made based on a conclusion it was the best likely outcome for the public a House of Commons committee was told today.

It was a deal years in the making though industry observers say that it didnt have to beIn striking an agreement to escape a potentially fatal criminal indictment for its sale of legally questionable tax shelters from 1996 to 2002 KPMG will pay a 456 million fine to the federal government and essentially spend the next 16 months on probation. The big four consultants harbour a small number of arrogant partners who disrupt the tax. On 8 February 2007 Deutsche Bank reached a settlement with hundreds of investors to whom it sold aggressive US.

Won a landmark tax-shelter case when accounting giant KPMG admitted to criminal tax fraud and agreed to pay 456 million in.

Https Pcaobus Org News Events Documents 10222015 Cea Deferred Prosecution Baugh Boone Khurana Raman Pdf

/https://www.thestar.com/content/dam/thestar/business/2016/05/13/complaints-filed-against-kpmg-over-isle-of-man-tax-controversy/kpmgjpg.jpg)

Complaints Filed Against Kpmg Over Isle Of Man Tax Controversy The Star

Top Kpmg Partners Are Held Over Tax Evasion The Times

Pdf Smoke And Mirrors Corporate Social Responsibility And Tax Avoidance

Kpmg Report Abusive Micro Captive Insurance Companies Kpmg United States

Https Oag Ca Gov Sites Default Files Kpmg Ac 2020 41 Pdf

Https Assets Kpmg Com Content Dam Kpmg Pdf 2016 01 The Common Reporting Standard Pdf

Albania Enlists Ey To Combat Tax Evasion And Economic Crime

Tax Dispute Resolution Kpmg Global

U S Attorney For The Southern District Of New York David Kelley U S Attorney General Alberto Gonzales And Irs Commissioner Mark Everson L To R Hold A News Conference To Discuss A Settlement

Https Assets Kpmg Com Content Dam Kpmg Ng Pdf Tax 2016 Tax And People Services Business School Brochure Pdf

Tax Dispute Resolution Kpmg Global

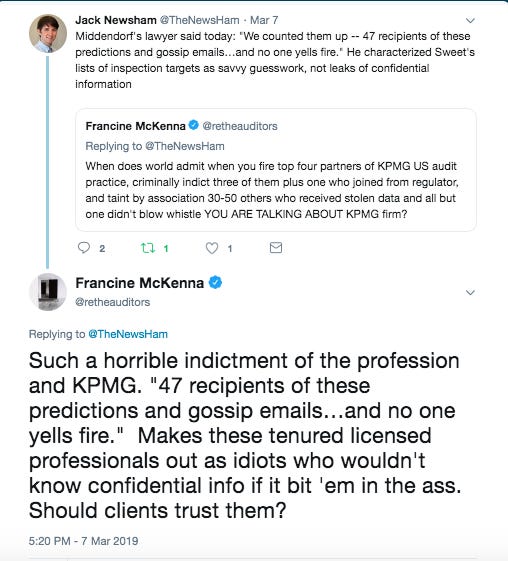

An Sec Fine For Kpmg In The Pcaob Data Theft Scandal And Another Horrible Revelation

Kpmg Haunted By Its Tax Shelter Follies

Om Demands Nine Months In Prison Against Former Kpmg Driver Teller Report

Singapore Incorporation Of Dental Practice Kpmg United States

U S Attorney For The Southern District Of New York David Kelley Speaks During A News Conference To Discuss A Settlement With Accounting Firm Kpmg Regarding Tax Fraud At The Justice Department On

Kpmg Faces Embarrassing Questions Over Its Role With The Co Operative Bank Co Operative News

Cra Officials Say Settlement On Kpmg Tax Evasion Scheme A Best Case Scenario Ipolitics