When Banks With Aml Violations Rebrand

By country Switzerland was the biggest offender in 2019 after a tier one Swiss bank received the biggest single fine at 51b for AML breaches by the French Criminal Court. FINRA reviews a firms compliance with AML rules under FINRA Rule.

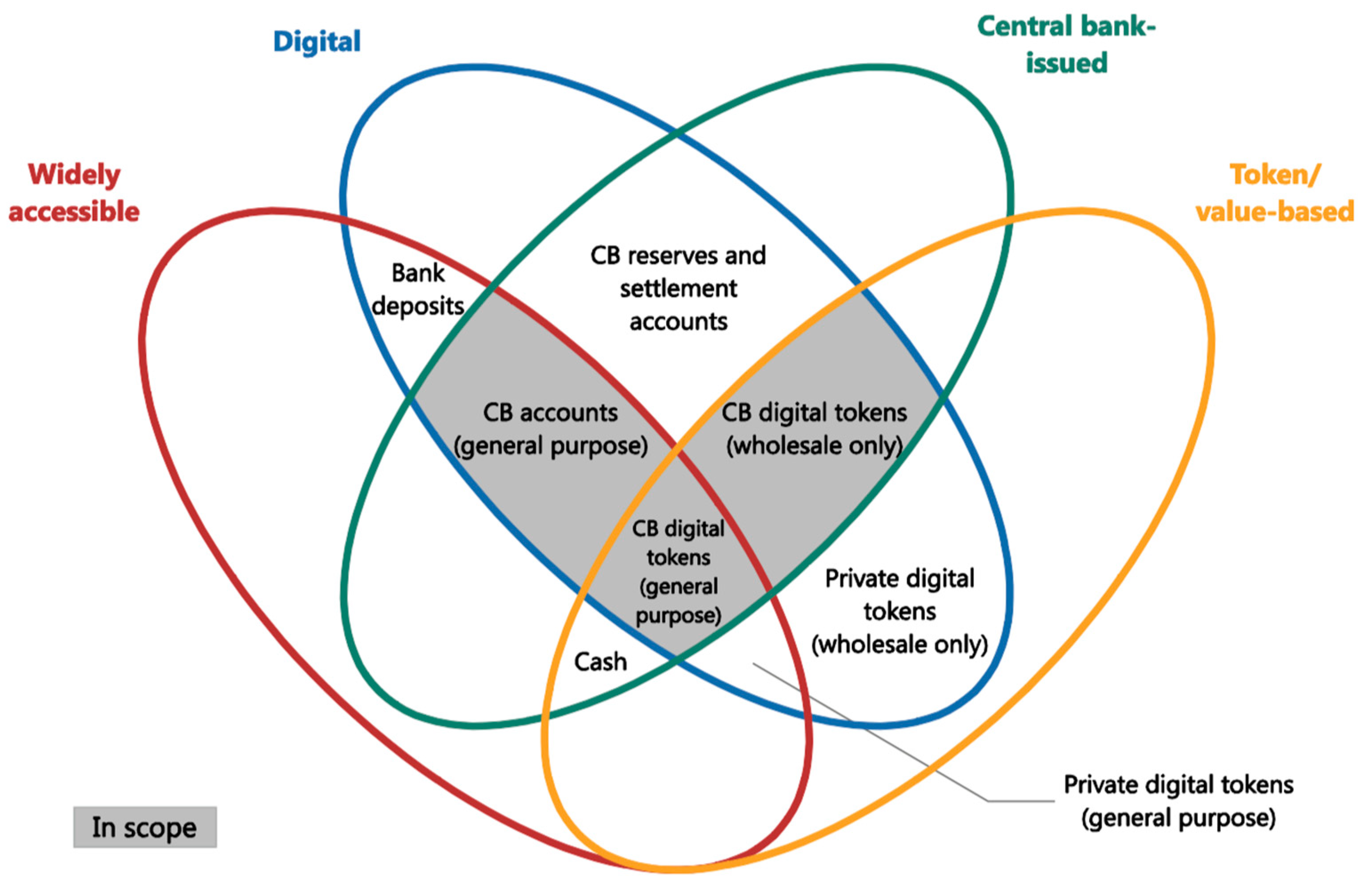

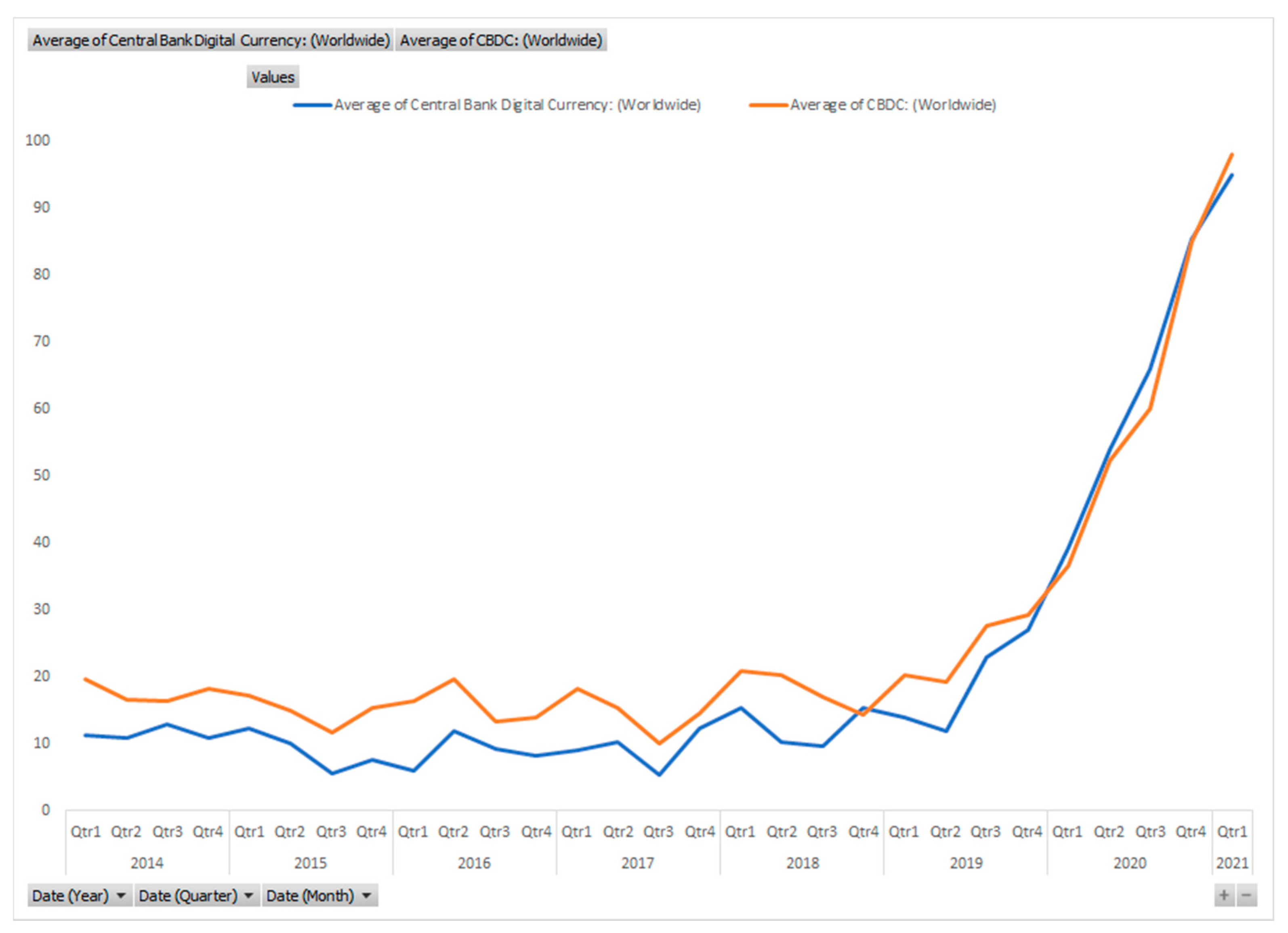

Future Internet Free Full Text From Bitcoin To Central Bank Digital Currencies Making Sense Of The Digital Money Revolution Html

The BSA is intended to combat money laundering and ensure that banks and financial institutions do not facilitate or become complicit in it.

When banks with aml violations rebrand. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. KCB Group KCBNR Equity EQTYNR Co-op Bank Kenya COOPNR StanChart Kenya SCBKNR and Diamond Trust DTKNR are 5 banks that faced AML fines.

Bank for his alleged failure to prevent Bank Secrecy Actanti-money laundering BSAAML violations that took place during his. AML regulations contain measures that companies must take to detect and prevent financial crimes and these regulations are determined by AML regulators and are a guide for businesses. BSA-AML Civil Money Penalties.

12 of the worlds top 50 banks were fined for non-compliance with AML KYC and sanctions violations in 2019. Bank National Association US. More than 8 billion in AML fines handed out in 2019 with USA and UK leading the charge.

Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. There are hundreds of local and global regulators in total doing AML studies in the world. Earlier this month Lone Star National Bank in Texas was fined 2 million for failure to meet Bank Secrecy Act anti-money laundering requirements from 2010-2014.

The cases are arranged in reverse chronological order and include the name and asset size when known. Bancorp has agreed to pay 613 million in penalties to state and federal authorities for violations of the Bank Secrecy Act and a faulty anti-money-laundering program. In a joint statement the Federal Reserve Federal.

From January 1 to March 31 2021 17 banks were fined over 1250521695 and 910192215. The Bank Secrecy Act. Attorneys Office of the Southern District of New York announced the coordinated actions Thursday.

Treasury Departments Financial Crimes Enforcement Network FinCEN determined that Lone Star willfully violated Bank Secrecy Act requirements after taking on a Mexican bank as a customer. M oney laundering is the process of making illegal income appear legal without arousing the suspicions of banks or law enforcement. A Flurry of AMLBSA Enforcement Cases.

Introduced in 1970 the Bank Secrecy Act BSA is the United States most important anti-money laundering law. The fine exceeds the banks 2018 net profit of 49b by 4. That is why Treasury and the Federal Banking Agencies have convened a working group to identify ways to improve the effectiveness and efficiency of the Bank Secrecy ActAnti-Money Laundering BSAAML regime Remarks by Sigal Mandelker Undersecretary Terrorism and Financial Intelligence US.

WASHINGTON Federal banking regulators on Thursday clarified that they generally do not issue cease-and-desist orders for minor deficiencies in a banks anti-money-laundering program or isolated violations of Bank Secrecy Act rules. Its as unique as snowflakes said Robert Mazur a former-undercover agent who infiltrated Pablo Escobars drug cartel. Department of the Treasury December 3 2018.

Banks or the banking sector are under the AML obligations because they are at risk of financial crime. WASHINGTONThe Financial Crimes Enforcement Network FinCEN has assessed a 450000 civil money penalty against Michael LaFontaine former Chief Operational Risk Officer at US. The violations occurred from at least 2008 through 2014 and caused millions of dollars in suspicious transactions to go unreported in a timely and accurate manner including proceeds connected to organized crime tax evasion fraud and other financial crimes laundered through the bank into the US.

Bank for his failure to prevent violations of the Bank Secrecy Act BSA during his tenure. 2021 is shaping up to be another blockbuster year for AML-related fines. Kenya Fines 5 Banks 375 Million for Anti-Money Laundering Violations.

The BSA imposes a range of compliance obligations. Our AML Bank Fines 2020 Report found that banks were fined over 3224875 355 billion and 2615333831 throughout 2020. You can launder money so many different ways.

AML Bank Fines Report Q1 2021. The fine exceeds the banks 2018 net profit of 49b by 4. Three federal regulators and the US.

On March 4 2020 the Treasury Departments Financial Crimes Enforcement Network FinCEN issued a consent order assessing a 450000 civil money penalty against Michael LaFontaine a former Chief Operational Risk Officer at US. Regulators issue guidance on AML enforcement actions. According to the NYFDS the offsetting transactions among the banks were not justified by any business purpose.

Bank used automated transaction monitoring software to spot. By country Switzerland was the biggest offender after a tier one Swiss bank received the biggest single fine at 51bn for AML breaches by the French Criminal Court. Twelve of the worlds top 50 banks were fined for non-compliance with AML KYC and sanctions violations in 2019.

Deutsche Bank paid the NYDFS a 425 million fine for violations of New York AML laws relating to mirror trading schemes among the banks Moscow London and New York offices that laundered 10 billion out of Russia. Five commercial banks operating in Kenya were fined 375 million due to disruptions in AML compliance processes. Encompass has carried out an analysis of Anti-Money Laundering AML related penalties handed down between 1 January and 31 December 2019 revealing that barring a massive 9 billion penalty in 2014 last year could have been a record at nearly double the overall actions and total penalty.

Deutsche Bank has identified serious failures in its screening of cheques and high-value electronic payments for anti-money laundering AML and sanctions compliance purposes the lender told the Financial Times. The lapses which went undetected for years and were discovered as the result of an internal audit include a filtering gap that affected its monitoring of cheques written by.

European Central Bank S Cbdc Borrows Bitcoin S Pseudo Anonymity Cryptoworld World Club

Sec Filing Lava Therapeutics N V

Indonesia S Central Bank Marshals Staff To Enforce Crypto Payments Ban Blickblock Re

European Central Bank S Cbdc Borrows Bitcoin S Pseudo Anonymity Cryptoworld World Club

Denmark S Largest Bank Cautious On Crypto But Won T Interfere Blickblock Re

Https Papers Ssrn Com Sol3 Delivery Cfm Ssrn Id3802556 Code485747 Pdf Abstractid 3775136 Mirid 1

A Crackdown On Financial Crime Means Global Banks Are Derisking Financial Money Laundering Crime

Anti Money Laundering Aml Investigation Money Laundering Investigations Case Management

Woori Becomes Latest Major Korean Bank To Announce Crypto Custody Services Blickblock Re

Https Www Mdpi Com 1999 5903 13 7 165 Pdf

2019 Cyprus Country Report By Countryprofiler Cyprus Issuu

3 6 Billion Crypto Heist South African Bank Denies Business Relationship With Fraud Accused Africrypt Jackofalltechs Com

European Central Bank S Cbdc Borrows Bitcoin S Pseudo Anonymity Cryptoworld World Club

And Exposure Management With Data Insights

Sec Filing Lava Therapeutics N V

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

Future Internet Free Full Text From Bitcoin To Central Bank Digital Currencies Making Sense Of The Digital Money Revolution Html